In the age of digital, where screens dominate our lives yet the appeal of tangible, printed materials hasn't diminished. In the case of educational materials or creative projects, or simply adding an element of personalization to your space, Gst Transport Rules are a great resource. Through this post, we'll take a dive into the world of "Gst Transport Rules," exploring what they are, where you can find them, and what they can do to improve different aspects of your life.

Get Latest Gst Transport Rules Below

Gst Transport Rules

Gst Transport Rules -

Further in terms of rule 56 of the CGST Rules 2017 you are required to maintain records of goods transported delivered and goods stored in transit by you along with the GSTIN

Key Points on GST in the Transport Sector GST registered GTAs must issue e way bills for road transportation of goods exceeding Rs 50 000 in value GTAs can claim ITC on

Printables for free include a vast range of printable, free materials that are accessible online for free cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and many more. The benefit of Gst Transport Rules lies in their versatility as well as accessibility.

More of Gst Transport Rules

Businesses With Turnover Over Rs 2 Cr Can Start Filing GST Audit

Businesses With Turnover Over Rs 2 Cr Can Start Filing GST Audit

As per Notification No 13 2017 Central Tax Rate dated 28 06 2017 Supply of Services by a Goods Transport Agency GTA in respect of transportation of goods

Accordingly it is clarified that w e f 01 01 2021 in case of debit notes the date of issuance of debit note not the date of underlying invoice shall determine the relevant financial

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: It is possible to tailor the templates to meet your individual needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Educational Worth: Free educational printables are designed to appeal to students of all ages, which makes the perfect tool for parents and teachers.

-

Accessibility: Quick access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Gst Transport Rules

Apply For New GST Registration GST Registration Online Here

Apply For New GST Registration GST Registration Online Here

Under the Goods and Services Tax GST regime a Goods Transport Agency GTA is required to file three types of GST returns GSTR 1 GSTR 3B and GSTR 9 GSTR 1 GSTR 1 is a monthly or

Attention is invited to sub section 8 of section 12 of Integrated Goods and Services Tax Act 2017 hereinafter referred to as IGST Act which provides for the place of supply

In the event that we've stirred your curiosity about Gst Transport Rules Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Gst Transport Rules to suit a variety of goals.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching materials.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs are a vast range of topics, ranging from DIY projects to planning a party.

Maximizing Gst Transport Rules

Here are some innovative ways for you to get the best use of Gst Transport Rules:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print free worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Gst Transport Rules are a treasure trove of practical and imaginative resources which cater to a wide range of needs and desires. Their access and versatility makes them an invaluable addition to both personal and professional life. Explore the world of Gst Transport Rules now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can print and download these files for free.

-

Can I make use of free printables for commercial uses?

- It's determined by the specific conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright problems with Gst Transport Rules?

- Certain printables may be subject to restrictions in their usage. Be sure to check the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home using any printer or head to a print shop in your area for top quality prints.

-

What software is required to open printables that are free?

- The majority of printed documents are in PDF format. These can be opened with free software like Adobe Reader.

Is GST Mandatory For Udyam Registration Compulsory Or Not

FAQs On E Invoicing Get Set Taxes

Check more sample of Gst Transport Rules below

Transport Rules And Manufacturing Technology Business Communication

Gst Registration Service At Rs 499 session Gst Registration Services

10 Days GST Return Service Accounts Details Rs 1000 month RCS GST

Singapore Company GST Registration Procedure Importance And

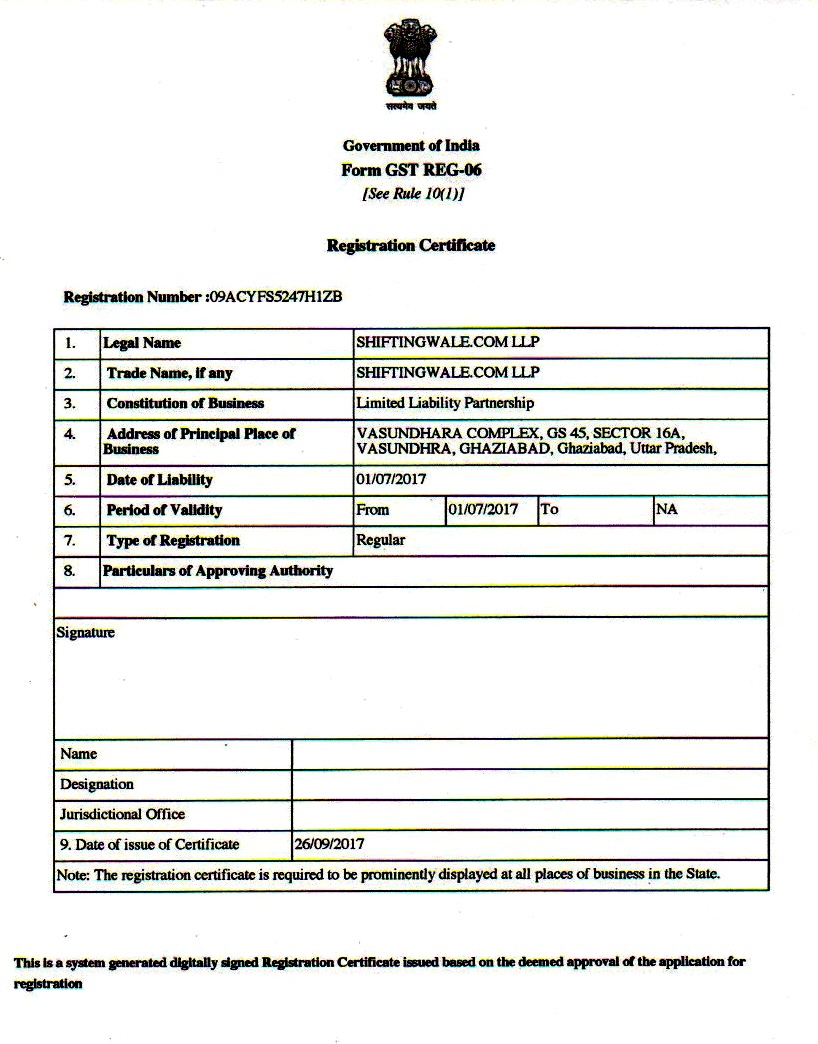

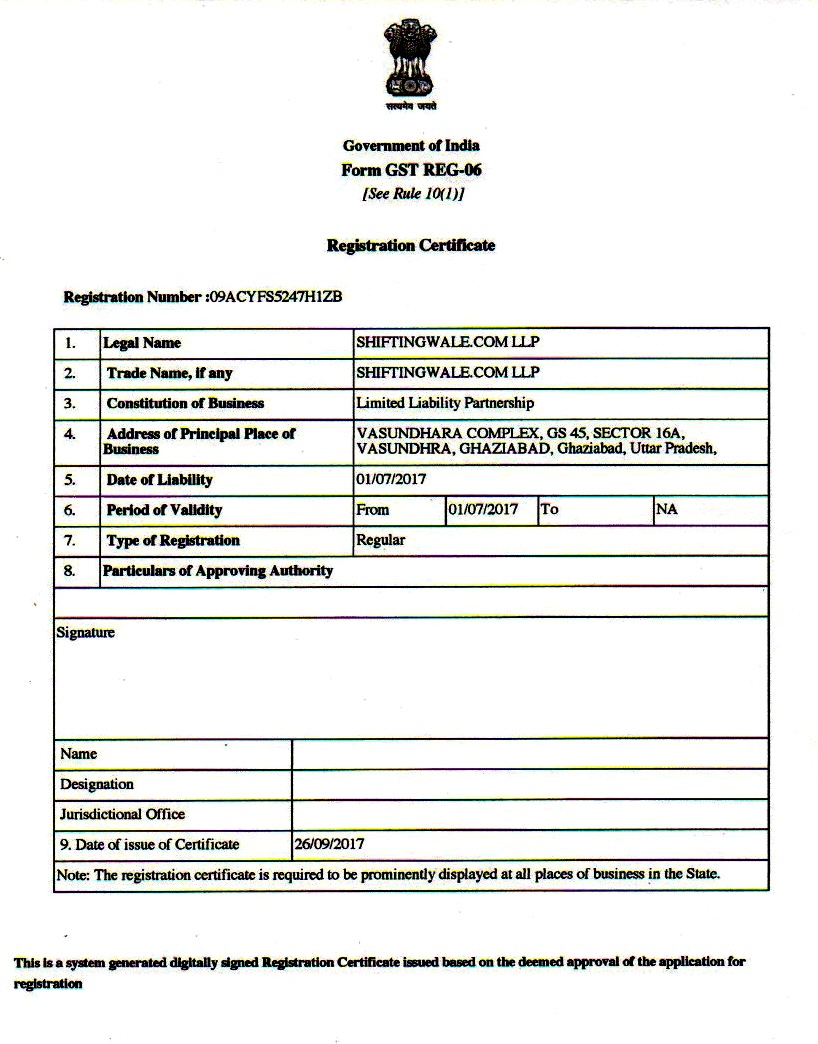

ShiftingWale Com GST Number

Offline Multi user Saral GST Software Free Demo Trial Available

https://blog.credlix.com/understanding-gst-in...

Key Points on GST in the Transport Sector GST registered GTAs must issue e way bills for road transportation of goods exceeding Rs 50 000 in value GTAs can claim ITC on

https://www.logipe.com/blog/gst-on-transportation

The basic rate of GST is 5 on transportation related businesses and a GTA is not permitted to claim input tax credits ITC on the goods and services used to

Key Points on GST in the Transport Sector GST registered GTAs must issue e way bills for road transportation of goods exceeding Rs 50 000 in value GTAs can claim ITC on

The basic rate of GST is 5 on transportation related businesses and a GTA is not permitted to claim input tax credits ITC on the goods and services used to

Singapore Company GST Registration Procedure Importance And

Gst Registration Service At Rs 499 session Gst Registration Services

ShiftingWale Com GST Number

Offline Multi user Saral GST Software Free Demo Trial Available

Activity Based Transport

GST State Code List Jurisdiction State Central FlexiLoans

GST State Code List Jurisdiction State Central FlexiLoans

How GST Return Filing Works For The Indian Hospitality Industry